Wait...How can Ampez afford 14%?

Good question. One that is asked often. When Ampez first started, they were self-funded. Being successful and looking to expand, Ampez began to have their projects funded by big banks. Because of the nature of lending practices of banks, they took usually around 30 days to close a deal. This was bad. Ampez was not being competetive in the buying market. Ampez was losing out on profitable deals, because of the slow pace of banks.

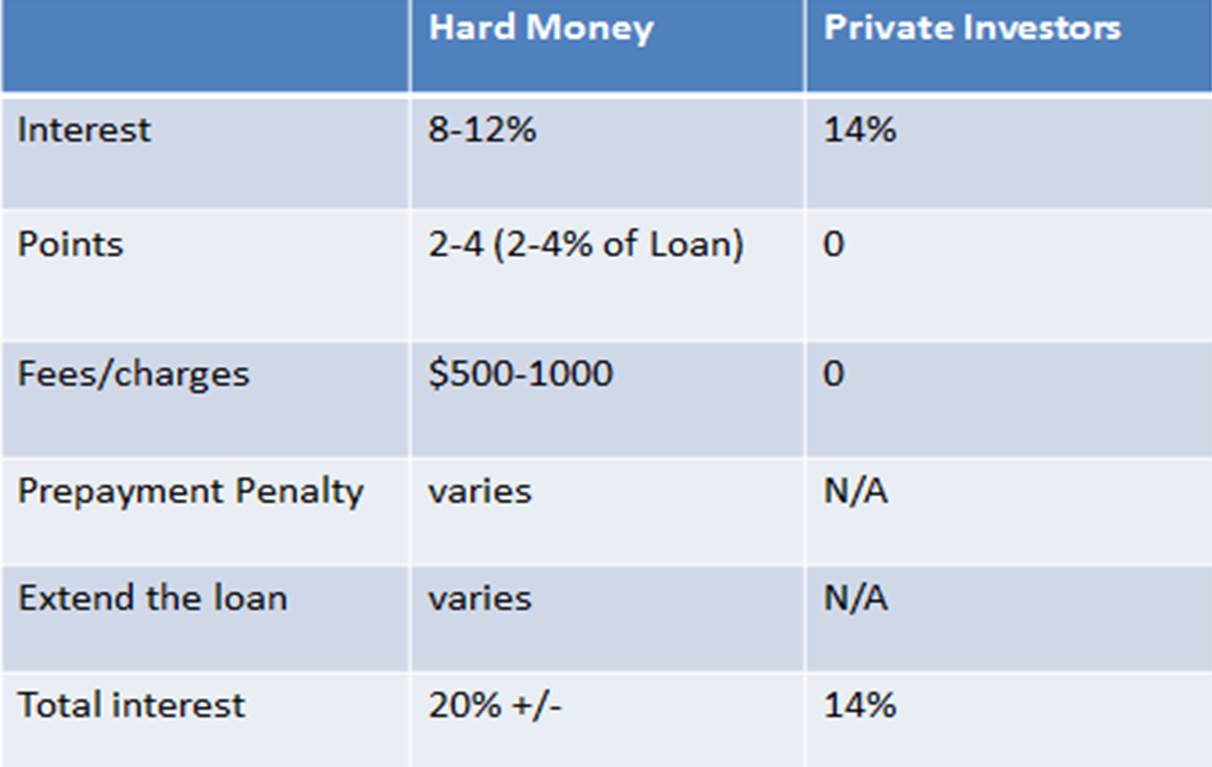

So, next Ampez started having some of their projects funded by private lenders, also known as hard money lenders. They closed very fast on funding projects for Ampez. This was good.

Their services, however, were expensive. The interest only payments were usually between 8-12%. They charged points on the loan costing thousands of dollars. Then there were origination

thousands of dollars. Then there were origination and underwriting fees. If projects were finished to early some lenders would charge a fee. On the other hand if some were not closed in the lenders time frame they would charge a fee. In a typical project Ampez was usually paying around 20% or more after it was all said and done.

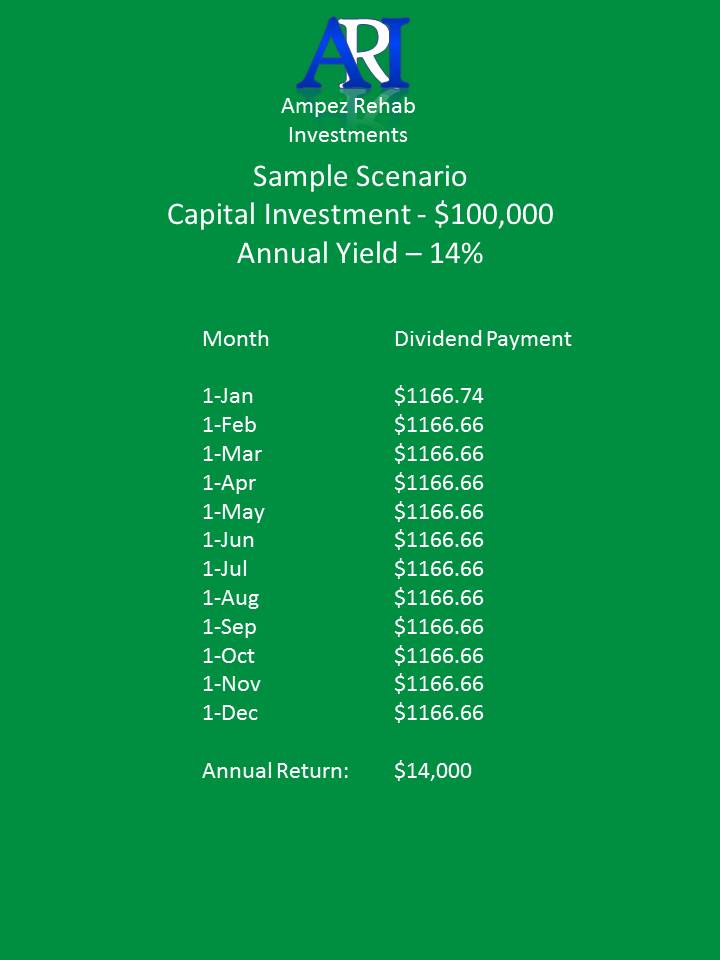

Paying Private Investors a high yield of 14% has literally saved hundreds of thousands of dollars.

T - 559.272.3902 [email protected]

Ampez Rehab Investments LLC

8050 N Palm #300 Fresno,CA 93711

559.320.5968

You Stay Informed...Always.

Once your money is placed in a project you will receive a log in to a website where you can monitor the process at work. See regularly updated pictures of the home being remodeled. View property information and records. See a timeline from acquisition to sale. It is easy to view and articulate what your money is actually doing. Be involved without actually being at the jobsite.